The 50/20/30 Rule of Budgeting

Budgeting your expenses seems tedious or even unnecessary to some, but is a vital practice to those who wish to save enough not only for retirement but for other big-ticket items. Vacations, new cars, maybe even a cottage on the ocean can all be attainable with a proper budget.

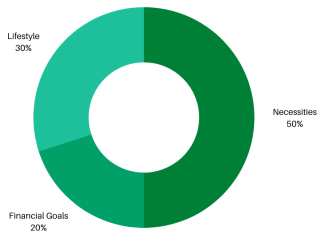

An easy-to-remember formula for your monthly budget is the 50/20/30 rule:

Necessities, 50%

50% of your income should be allocated to the necessities like rent or mortgage payments, utilities, loan payments, and in many cases food, clothing, and transportation.

Financial Goals, 20%

20% of your income should be allocated to financial goals like retirement, vacations, your rainy-day fund, and general savings.

Lifestyle, 30%

The final 30% of your income can then be allocated to your “Lifestyle”. This includes entertainment, concerts and movies, hobbies, and the food or clothing you might not necessarily need, like takeout and that Gucci bag you’ve been eyeing online.

While this formula might not be feasible for everyone, it reminds us of the principles of good money management: pay your bills on time, pay yourself, and spend wisely on luxury items. If you have a sudden drop in your income, then necessities will most certainly take more than 50% of your income. If you get a raise without increasing your necessities, then you have more funds to play with allocating towards that vacation or your retirement plan. The key is to identify your short and long-term financial goals and plan accordingly.

If you are working toward one or more financial goals, from finally owning your own home to retiring early, speak with one of our advisors to gain some insights into a budgeting formula that could work for you.

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. This article was produced by Advisor Stream for the benefit of Rick Irwin, Financial Advisor at Trinity Wealth Partners, a registered trade name with Investia Financial Services Inc. The information contained in this article does not necessarily reflect the opinion of Investia Financial Services Inc. and comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities.

Mutual Funds, approved exempt market products and/or exchange traded funds are offered through Investia Financial Services Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the simplified prospectus before investing. Mutual funds are not guaranteed and are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. There can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Fund values change frequently, and past performance may not be repeated. Investia is not liable and/or responsible for any non-mutual fund related business and/or services.

Life Insurance related services and products are provided through PPI.