Ageing Well: Two Tax Credits That Can Help

Help, I’ve fallen and I can’t get up!

Remember that line from an ad a few years ago? I have a big rowdy family and when we get together this means there are 4 generations talking, laughing, and generally seeing how much mischief they can stir up. And while there are stronger connections between some members of the family than others, we all pretty much get along and help each other through the various curveballs life throws at us. Our four generations span from infant to 86 years, so we’re still adding to the clan, but the reality is more of us are on the “senior” end of the hierarchy than ever before.

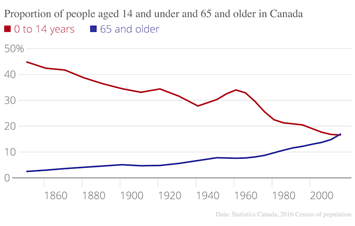

Canada’s population is aging. The graph to the right (compliments of Stats Can) fascinates me. The percentage of seniors, compared to the population as a whole, has been steadily increasing due to improved healthcare and longevity but the percentage of children has been declining pretty steadily (except for the post war baby boom). In fact, according to the 2016 census, seniors (age 65 and older) outnumbered children (14 and younger) for the first time ever. Who’s going to look after us?

While your mortgage may be paid off, the cost of living, as a senior, increases in some key areas: namely healthcare and assisted living. There are various tax credits that become more readily available as a senior to offset some of these costs. Be sure to take advantage of any tax credits available to offset the high expense, or perhaps that of caring for an aging parent or an adult dependent child. The Disability Tax Credit (DTC) and the Canada Caregivers Credit (CCC) are two non-refundable tax credits that may help you reduce your taxable income.

Disability Tax Credit

The DTC is available to any Canadian, young or old, who has a marked disability affecting their everyday lives. The Canada Revenue Agency has given a list of scenarios to help give insight into whether or not you may qualify. If you are eligible for the Disability Tax Credit, you may also be able to open a Registered Disability Savings Plan (RDSP). Make sure you check with your tax advisor to see if you could qualify.

Canada Caregivers Credit

The CCC credit is similar to the DTC, but is granted to the person providing the care. This may be an adult child caring for their parent, an adult caring for their sibling, a senior caring for their disabled spouse, or any number of scenarios in which a dependent is being cared for by another adult. Qualifying for the CCC is tricky as it depends on your, and your dependent’s, net income. Speak with a tax professional to gauge your qualifications.

Do your Research

I’ve learned through my own experience that there are many agencies and organizations with resources and programs out there, but knowing which ones are right for you or even knowing there is such a program is often challenging. (Because sometimes we don’t know what we don't know!) One of my favorite resources is the national and provincial 211 services. You can go online at www.211.com or call 24 hours a day, 7 days a week and get help connecting with the right information or services available.

And remember, lots of things get better with age...fine cheeses and good wines come to mind...

Sources:

Disability Tax Credit https://www.canada.ca/en/revenue-agency/services/tax/individuals/segments/tax-credits-deductions-persons-disabilities/disability-tax-credit.html

Canada Caregiver Credit https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/canada-caregiver-amount.html

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. This article was produced by Advisor Stream for the benefit of Rick Irwin, Financial Advisor at Trinity Wealth Partners, a registered trade name with Investia Financial Services Inc. The information contained in this article does not necessarily reflect the opinion of Investia Financial Services Inc. and comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities.

Mutual Funds, approved exempt market products and/or exchange traded funds are offered through Investia Financial Services Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the simplified prospectus before investing. Mutual funds are not guaranteed and are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. There can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Fund values change frequently, and past performance may not be repeated. Investia is not liable and/or responsible for any non-mutual fund related business and/or services.

Life Insurance related services and products are provided through PPI.