How Charitable Donations can save you income tax

At this time of year, we often think about giving back and donating to worthy causes. Fortunately, doing so can bring nice tax savings, especially if structured properly. The amount that can be donated is very generous; a taxpayer can claim donations up to 75% of their net income. There are special rules for the year of death where up to 100% of income can be claimed, on the final tax return or the preceding year.

A donation must be received by the charitable institution by December 31st in order to receive a charitable donation receipt for that tax year. Only gifts to registered charities and other qualified donees can be claimed as charitable donations. The CRA website has a charities registry page where you can search charity listing to see if a particular charity is a registered charity in Canada. This is also a good resource to see how much of a particular charity’s budget is spent on marketing and overhead, versus actual charitable works.

If any advantage was received in return for the donation (i.e. a concert ticket or meal) then the donation claim is reduced by the value of the advantage.

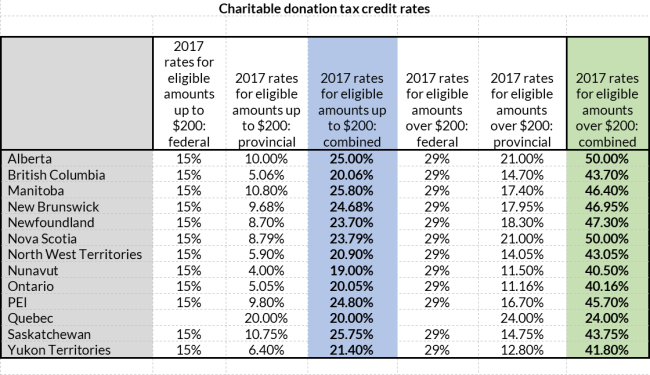

How much you give has a big impact as donations of $200 or less receive a lower tax credit than ones over $200, as per the chart to the right. To try and maximize tax savings, you can save donation receipts and combine up to 5 years worth on one tax return, to get as much as possible in the higher tax credit zone.

Note: there are new rules that affect donations for individuals whose taxable income exceeds the top personal tax bracket, $221,708 for the 2021 tax year.

Example: A Nova Scotia taxpayer earning less than $200,000 claims charitable donations of $1000 on their tax return. The amount saved would be $457.58. ($47.58 on the first $200 and $400 on the remaining $800)

However, if you have non-registered investments that have appreciated in value you can donate the securities ”in-kind” and avoid paying capital gains on the growth of the investment, as well as receiving a dollar for dollar tax credit for the full amount of the gift.

Example: Mr. & Mrs. Smith cash out an investment with a cost base of $10,000 and a market value of $25,000. This triggers a capital gain of $15,000. Using the current inclusion rate of 50%, $7,500 is added to their income for the year. They receive a tax credit of $12,447.59. ($47.59 on the first $200 and $12,400 on the remainder of the gift.) Assuming that they are each in a 37% tax bracket, the taxes payable on the cashing out of their investments would mean a tax bill of $2775 for a net refund of $9,672.59. However, if they had donated the investments directly, they would have avoided the $2,775 tax on the capital gain and saved the full $12,447.59. If you are considered donating non-registered investments, it’s important to carefully structure the donation so that you can receive the maximum benefit.

You can either gift the securities directly to the charity or you could set up a private foundation. These are available in mutual fund structures and require a minimal amount of paperwork to establish. Once the funds are in the foundation, any future growth is tax-free. You have complete control over which charities will receive grants annually and how the funds will be dispersed upon your passing.

Whatever the method, your donations will be put to good use in the community or abroad. It’s important to know the tax implications so that generosity has the biggest impact to your bottom line.

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. This article was produced by Advisor Stream for the benefit of Rick Irwin, Financial Advisor at Trinity Wealth Partners, a registered trade name with Investia Financial Services Inc. The information contained in this article does not necessarily reflect the opinion of Investia Financial Services Inc. and comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities.

Mutual Funds, approved exempt market products and/or exchange traded funds are offered through Investia Financial Services Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the simplified prospectus before investing. Mutual funds are not guaranteed and are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. There can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Fund values change frequently, and past performance may not be repeated. Investia is not liable and/or responsible for any non-mutual fund related business and/or services.

Life Insurance related services and products are provided through PPI.