Using a Cash Wedge to Manage Your Income

When markets fluctuate, it makes a big difference to your long-term plan, whether you're adding or withdrawing funds from your portfolio. During the accumulation phase, you can benefit from Dollar-Cost Averaging to take advantage of market ups and downs while you're putting money in. But what happens when it's time to enjoy those savings we diligently squirrelled away every month? How do we protect our portfolios from those same ups and downs while supplementing our monthly income?

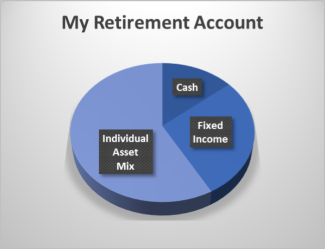

Using a strategy called the "Cash Wedge," we aim to lessen the impact of market fluctuations within your registered portfolio when drawing an income. Essentially, we divide your portfolio into four components; three one-year income funding buckets and the balance in the long-term portfolio. The specific amount in each of these components depends on your specific income needs, but it typically looks something like the graph on the right.

The first bucket holds the money you want/need in the short term. This sleeve of the retirement portfolio typically invests in low-risk cash assets like high-interest savings accounts or money market funds. We like to see at least 12 months of income here. For example, if you're withdrawing $500 a month for expenses, you should have about $6000 in the 1-year bucket.

The second bucket invests in lower volatility fixed-income investments such as bond funds. These investments create a relatively stable portion in the portfolio that offers some growth without taking too much risk.

The third bucket would invest in a conservative monthly income fund, which, while having a higher degree of volatility than the first two buckets, will still offer stability in the event of a sideways market lasting several years.

The remainder of the portfolio invests in the asset mix that suits your individual investment goals and risk profile, and this is where the majority of the growth occurs. Typically, the majority of this component of the portfolio uses balanced funds as the basic building blocks. Balanced funds have their holdings split between stocks and bonds to moderate volatility. However, their values change daily depending on market movements. Ideally, we don't want to be in a forced selling position during moments of market weakness to provide income. Doing so can result in a permanent loss of capital.

Here's how it works: As the one-year (cash) bucket becomes depleted, it gets replenished annually in two ways, depending on market conditions. In the good years, this occurs from profit-taking on the better-performing funds in the longer term, core portfolio. In years where the longer-term portfolio experiences losses, the one-year bucket is replenished from the year two bucket. In those years, the money in the year-three bucket moves into the more conservative year-two bucket. Cascading annual income funding in this way buys time for the longer-term portfolio to recover and diminishes the need to sell during periods of losses.

Dividing your portfolio in this way allows us to manage the withdrawal risks and enables us to secure your income without losing out on potential growth from equity markets.

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. This article was produced by Advisor Stream for the benefit of Rick Irwin, Financial Advisor at Trinity Wealth Partners, a registered trade name with Investia Financial Services Inc. The information contained in this article does not necessarily reflect the opinion of Investia Financial Services Inc. and comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities.

Mutual Funds, approved exempt market products and/or exchange traded funds are offered through Investia Financial Services Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the simplified prospectus before investing. Mutual funds are not guaranteed and are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. There can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Fund values change frequently, and past performance may not be repeated. Investia is not liable and/or responsible for any non-mutual fund related business and/or services.

Life Insurance related services and products are provided through PPI.