Will your emotions hijack your investment strategy?

American Thanksgiving on November 25, (sorry, but not sorry, our turkeys were enjoyed a month ago!) begins the countdown to Christmas. It is immediately followed by the much anticipated and anxiously awaited “Black Friday” celebrations, bringing with it crowds and conflict at shopping malls and big-box stores.

Black Friday these days denotes the start of a retail shopping spree but it was originally coined by the Philadelphia police department because so many people went out to shop that it caused traffic accidents and chaos in overcrowded stores and congested parking lots. Retailers however didn’t appreciate the negative connotations or the associations to Black Monday, on October 19, 1987, when the Dow Jones Industrial Average dropped 22.61% or Black Thursday, on October 24, 1929, which signalled the start of the Great Depression. They decided to rebrand it as their own and signify their best sales days, moving them out of the red and into the black.

Now I like a good sale too, but what has this to do with our investing strategy? Well, we know when the sale is happening so we’re all ready to buy. This isn’t possible with markets. The gurus on TV can look at averages and volumes and sentiment and all manner of data but no one knows with certainty when markets will go up. Or when they’ll go down. You can’t plan on picking the sale day in the markets. You may have heard the adage, “The best time to invest is today and the next best time is tomorrow.” It’s true!

What about the crowds and the lineups and even the potential of actual physical danger to ourselves of shopping on this particular day? The volatility in the malls can make us fearful of going out. This can happen to us when we’re investing too. We might decide to stay on the sidelines when things are uncertain and we’re afraid, causing us to miss the sale altogether. Or we allow ourselves to get carried along with the crowd, thinking they know something we don’t and abandon the strategies we’ve developed to suit our goals when we were more rational and calm.

Sticking to our budget can be a challenge when faced with all those shiny sale stickers or this year’s must-have toy or gadget. There’s a reason retailers put those fun “don’t forget me” items next to the checkouts, it works! When we invest it’s important to remember the budget and our goals and why we planned in the first place. This will make us much more successful than giving in to the “flavour of the month”.

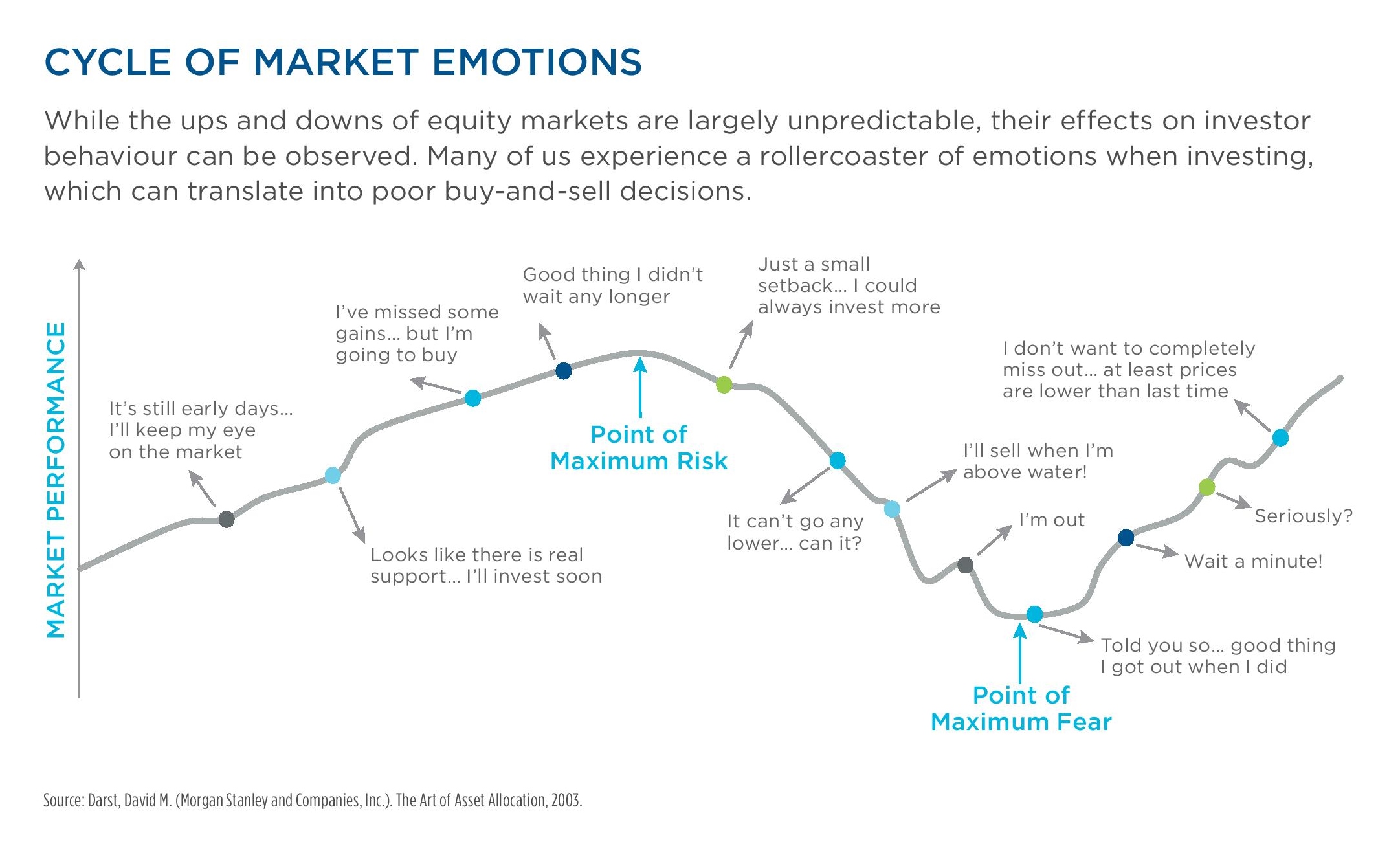

This chart helps us see how we can be ruled by emotions and make the wrong decisions. Your advisor knows emotions are powerful when things are uncertain and staying the course through all market cycles isn’t always easy. Talk to them before the roller coaster starts so you know you can ride out the waves with confidence.

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. This article was produced by Advisor Stream for the benefit of Rick Irwin, Financial Advisor at Trinity Wealth Partners, a registered trade name with Investia Financial Services Inc. The information contained in this article does not necessarily reflect the opinion of Investia Financial Services Inc. and comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities.

Mutual Funds, approved exempt market products and/or exchange traded funds are offered through Investia Financial Services Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the simplified prospectus before investing. Mutual funds are not guaranteed and are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. There can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Fund values change frequently, and past performance may not be repeated. Investia is not liable and/or responsible for any non-mutual fund related business and/or services.

Life Insurance related services and products are provided through PPI.